About the Book Main objective of economic planning in India has been 'growth with justice'. Fiscal policy plays an important role to achieve this objective. Taxation being the important instrument of fiscal policy, is used to achieve the objectives of high rate of economic growth, economic stability and social justice. Income tax on 'individual' may be considered as the best among all the taxes because it ensures equity in the distribution of tax-burden and at the same time is better suited to achieve other socio-economic objectives. Estimation of tax incidence. evaluates the taxation policy regarding distribution of tax burden.

This book "Income Tax and Salaried Class" is an attempt to critically examine the incidence and effects of income tax on individuals earning income from 'salary'. The general nature of this study is empirical. The book consists of eight chapters.

The first chapter of introduction is exclusively written for research methodology.

In the second chapter, theories and principles of income taxation have been reviewed.

In the third chapter, it has been tried to sketch out the evolution of income tax system in India.

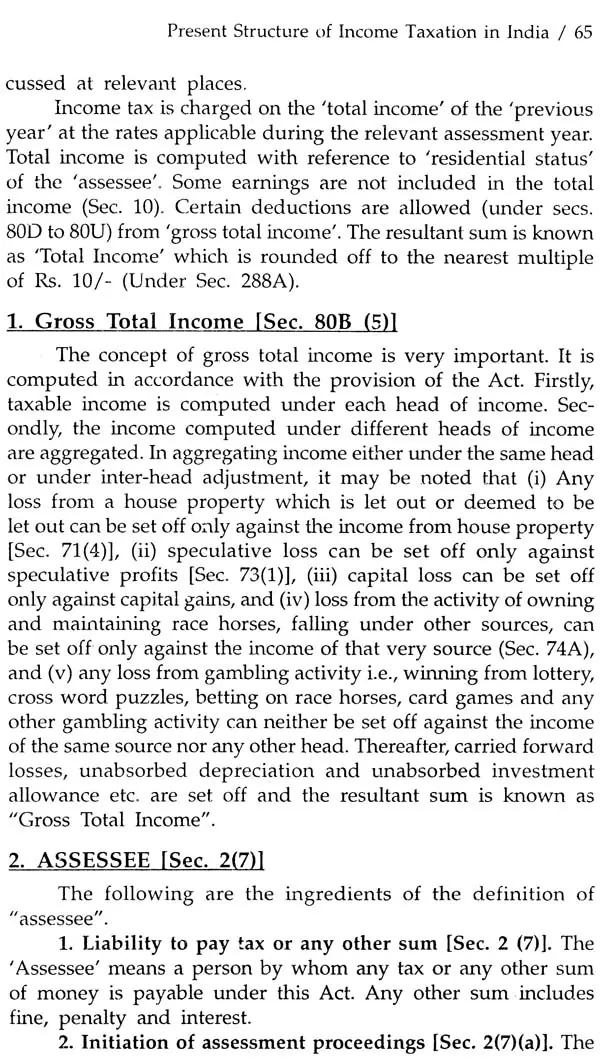

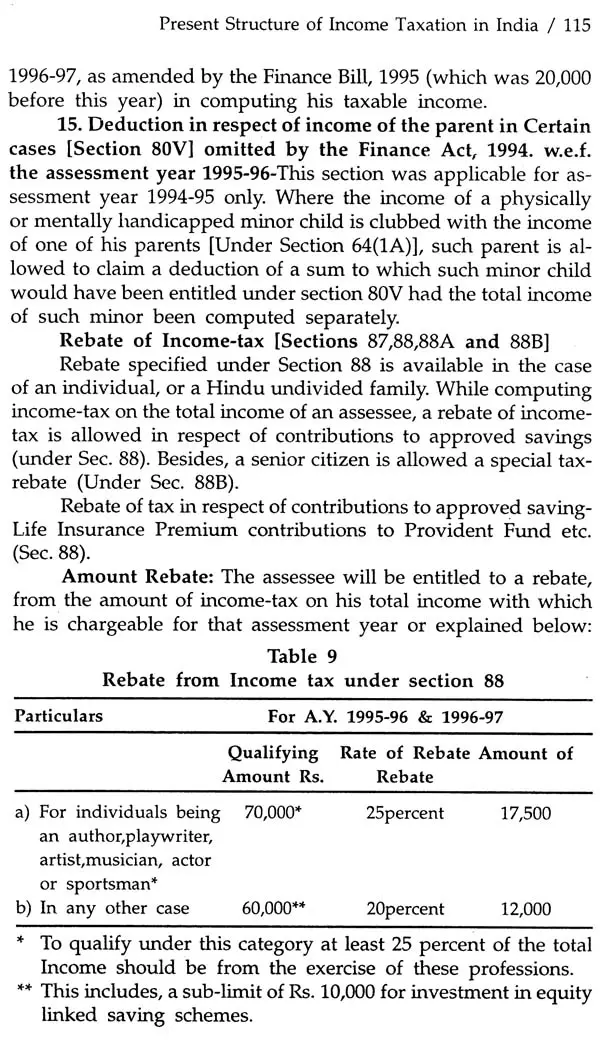

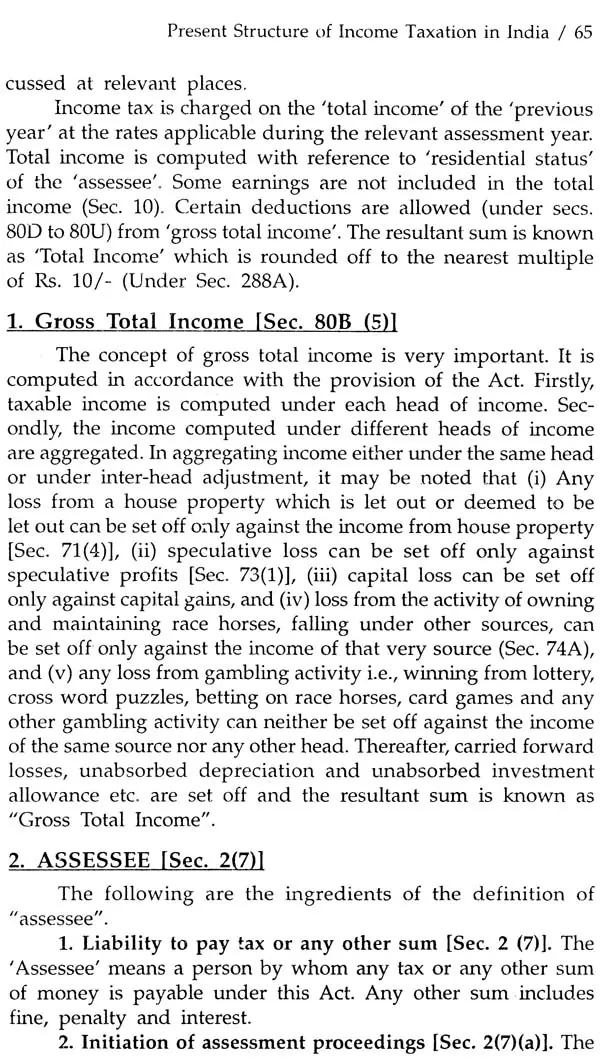

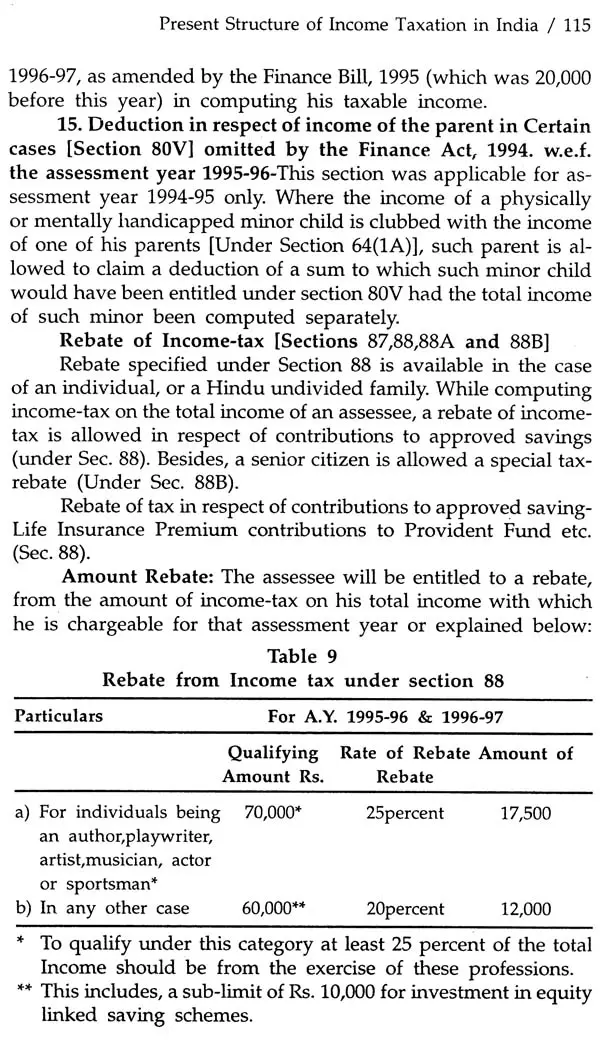

Fourth chapter is based on the primary, as well as, secondary data which analyse the structure of income taxation in India.

In the fifth chapter, effect of income tax on savings of the salaried class has been analysed with the help of primary and secondary data.

Sixth chapter primarily deals with primary data collected from the respondents to see the effect of income tax on consumption of the salaried class.

In the seventh chapter, effect of income tax on standard of living of the salaried class has been discussed.

Eighth chapter suggests the measures which can be taken to reduce burden of income tax on salaried class and check adverse effects of income tax on them.

About the Author Dr. Neelam Choudhary (1959) is a lecturer in the department of economics, University College, Maharshi Dayanand University, Rohtak, Since 1983.

Preface Fiscal policy plays an important role in developing countries to achieve the objectives of high rate of economic growth, economic stability and social justice. Income tax on 'individual' may be considered as the best among all the taxes because it ensures equity in the distribution of tax burden and at the same time is better suited to achieve other socio-economic objectives. Estimation of tax incidence evaluates the taxation policy regarding distribution of tax burden. Therefore, incidence and effects of income tax on individuals earning income from different source discover whether the tax system conforms to the principle of equity (equitable distribution of the tax burden) or not and whether the tax is levied according to the ability-to-pay of the individuals or not. The present study is an attempt to critically examine the incidence and effects of income tax on individuals earning income from 'salary'. This book categorized has been into eight chapters. The first chapter of introduction, is exclusively written for research methodology, part of which includes objectives of the study, research design, tools and techniques, and limitation of the study. In the second chapter, theories and principles of income taxation have been reviewed. In the third chapter, it has been tried to sketch out the evolution of income tax system in India; fourth chapter is based on the primary, as well as, secondary data obtained from various documents and reports which analyse the -structure of income taxation in India. Sources of taxable income, exemptions and deductions, and tax incentives for savings and investments have also been identified in this chapter. In fifth chapter, effect of income tax on savings of the salaried class has been analysed with the help of primary and secondary data. Sixth chapter primarily deals with primary data collected from the respondents to see the effects of income tax on consumption of the salaried class.

Introduction The economic structure of our country is multifaceted. The people are divided into various classes and income categories. There is a vast gap between the different income categories. In the employment sector people are either engaged in unorganized or organised sector. Agriculture is the biggest unorganized sector where most of our population is engaged for their livelihood. There are a number of privately owned companies, industries, firms etc. which provide employment to the population. Still, in India, people like to serve in the government organised sector because of its exclusive benefit of the sense of security. Therefore, we have taken our universe from the government organised sector. In the government organised sector the individuals who are also income tax payee and whose source of income is 'salary' have been the target of our study.

The revenue from the personal income tax not given separately in the Budgets of the Government of India. The head 'taxes on income other than corporation tax' includes both the personal income tax and tax on registered firms. Of course, the income tax on registered firms constitutes only a small proportion of this total. Figures relating to income tax on 'individual' is taken as personal income tax, since 'individual' tax payers account for more than 90 percent of the total number of personal income tax payers and their taxable income.

Book's Contents and Sample Pages