Monetary and Credit Policies of the Nepal Rastra Bank and their Impact on the Nepalese Economy (An Old and Rare Book)

Book Specification

| Item Code: | UAR977 |

| Author: | Pushkar R. Reejal |

| Publisher: | Ratna Pustak Bhandar, Nepal |

| Language: | English |

| Edition: | 1986 |

| Pages: | 110 |

| Cover: | HARDCOVER |

| Other Details | 9.00 X 6.00 inch |

| Weight | 280 gm |

Book Description

Although written primarily to meet the requirements of the stu dents of the Tribhuvan University, Kathmandu, this book can be useful to policy makers as well. Since a lot of series data are included as appendices in the book, it can act as a reference guide to advanced and research students of monetary economics who are interested in the problems of money and credit in developing countries like Nepal.

Written within the framework of macro-economic theory, this book deals comprehensively with the questions of control of money supply, transmission process of monetary policy, effectiveness of monetary instruments and the process of financial development. All these questions are analysed empirically in the context of the Nepalese economy.

In 1970 Dr Reejal was granted a research fellowship by the Ford Foundation to work at the Gra duate School of Public and International Affairs. University of Pittsburgh. Pittsburgh, Pn nsylvania. U.S.A. In 1977 the University awarded him. the Degree of Doctor of Philosophy in Economic and Social Develop ment. He was appointed Reader of Economic and Social Development in 1981 at the Public Administra lion Campus of the Institute of Management, Tribhuvan Univer sity, Kathmandu.

Dr Reejal is a keen observer of the Nepalese Economic Affairs and has several publication to his credit. His major work include Integracion of Women in Development: The Case of Nepal (1981). Several of his articles have been published in reputed national journals.

A widely travelled person, Dr Reejal has also acted as the Chairman of the Public Adminis tration Subject Committee in the Institute of Management, Tri bhuvan University, Kathmandu.

Written within the framework of macro-economic theory, the present study conducted by Dr. Reejal deals with the six questions which are fundamental to any discussion on monetary and credit policies. The six research questions empirically dealt by Dr. Reejal in this book are as follows: 1. Can the Nepal Rastra Bank control the supply of money?

2. Are the instruments used by the Nepal Rastra Bank adequate to achieving control of the money supply?

3. How important are the behaviour of the private sector in determining the money supply? 4. How important is 'the credit operations of the non-bank financial institutions in creating substitutes for money?

5. How does the monetary policy of the Nepal Rastra Bank affect the Nepalese economic system?

6. How effective is the monetary policy of the Nepal Rastra Bank in achieving its aim?

Although the readers are invited to go through this book and discover the validity of the empirical answers provided by Dr. Reejal by themselves, the answers, found by the author to the above mentioned six research questions are not only novel and interesting, but also valuable in understanding the workings of the Nepal Rastra Bank. An absorbing account of credit policies, the issue of financial layering, bank based strategy of the development of money and capital market has also been provided in this book.

Various policy options and their implications for growth, stability, balance of payments, exchange rate of Nepalese currency with other currencies, access to institutional credit and growth of money and capital markets are also discussed. Literature dealing with the monetary and credit policy of the Nepal Rastra Bank, their nature, problems and prospects are extremely deficient. The serious piece of work number no more than three or four and all need revisions and updating in the light of recent happenings and current issues. This study is offered as a modest contribution toward filling this gap.

The wide coverage and the nontechnical nature of the study has been intentional and was due to several factors. First, there was the need to conform to the outline prescribed by the Committee on Studies for Public Policies of the Public Administration Campus, Tribhuvan University, Kathmandu; in response to whose request the study was conducted in the first place. Second, the needs of the students of the Tribhuvan University, Kathmandu, was an equally important considera tion in this regard. Finally, the urge to gain a wider audience was also there. In an expanded version of the study, the author hopes to examine the subject matter more rigorously. The author will like to thank the Rector Office of the Tribhuvan University for granting sabbatical leave to the author for completing this study. The author will also like to express his indebtedness to the Research Wing of the Nepal Rastra Bank for offering valuable comments and suggestions in the first draft of this book. Needless to say that the author alone is responsible for any deficiencies that may have remained in this book.

First, can the Nepal Rastra Bank control the supply of money? Subsumed under this question are the questions of the adequacy of the monetary authorities' policy instruments in achieving control of the money supply, the relative impor tance of private sector behaviour in determining the money supply, and the importance of non-bank financial institutions in creating substitutes for money.

Second is the question of the transmission process of monetary policy. In other words, how does the monetary policy of the Nepal Rastra Bank affect the Nepalese economic system? and Third how effective is the monetary policy of the Nepal Rastra Bank in achieving its aim?

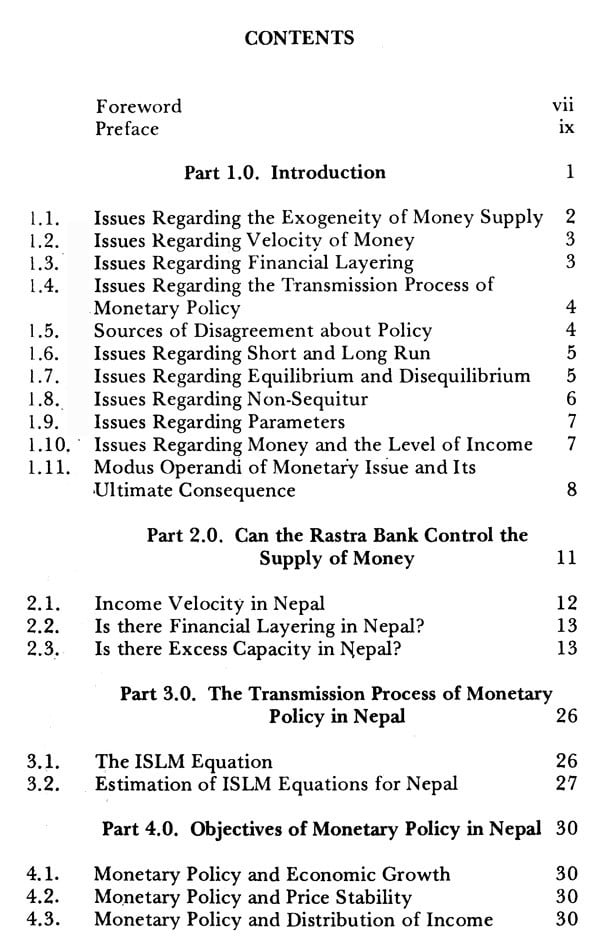

This study is divided into 5 parts. The subsequent sections of Part 1.0 discuss the major issues raised by the Monetarist and the Keynesians and the interrelation existing between them against the background of Nepal as far as possible. Part 2.0 is divided into three sections in which the capacity of the Nepal Rastra Bank to control the supply of money and the problems associated with it are discussed.

Part 3.0 discusses the transmission process of monetary policy under a Hicks-Hansen type of Keynesian model. The estimated parameters of the ISLM equations are presented in this part with the intention of assessing the relative impor tance of monetary policy in the context of Nepal.

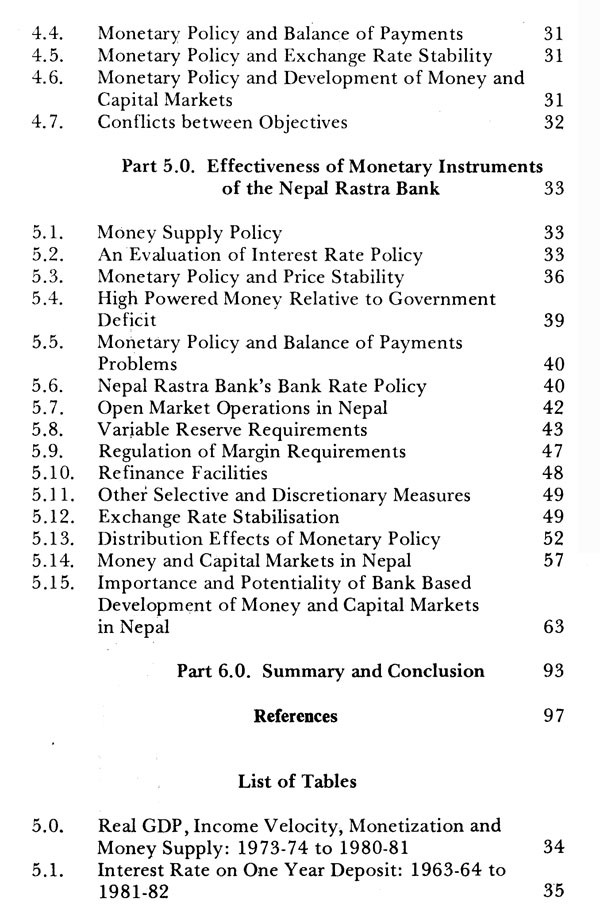

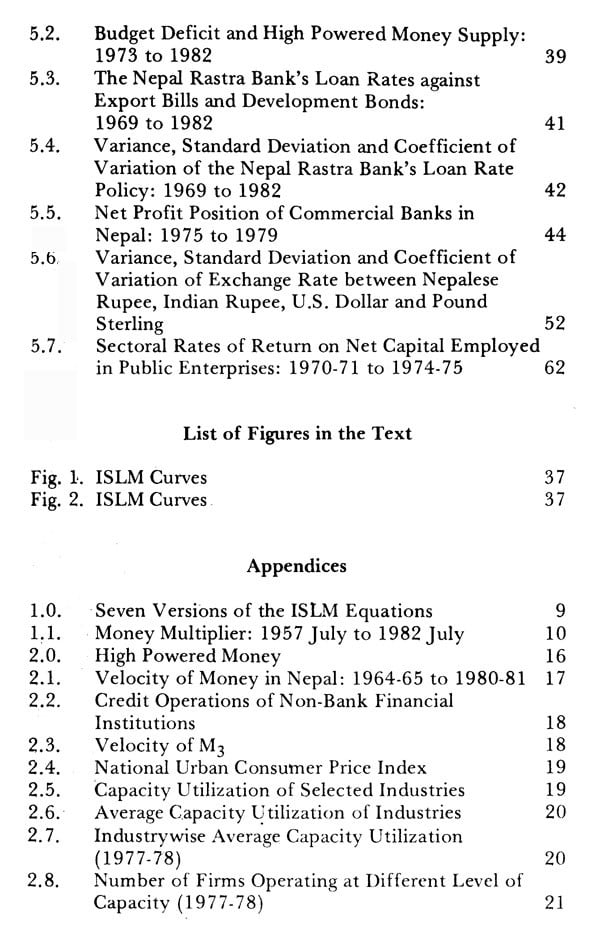

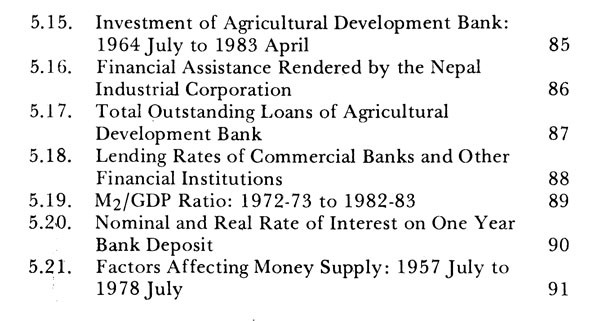

**Contents and Sample Pages**