The SBI Story : Two Centuries of Banking

Book Specification

| Item Code: | UAE323 |

| Author: | Vikrant Pande |

| Publisher: | Westland Publications Pvt Ltd., Chennai |

| Language: | English |

| Edition: | 2021 |

| ISBN: | 9789391234683 |

| Pages: | 201 (Throughout B/W Illustrations) |

| Cover: | HARDCOVER |

| Other Details | 9.50 X 6.50 inch |

| Weight | 400 gm |

Book Description

From princes to peasants, musicians to masons, cement plant owners to casual labourers the State Bank of India (SBI) has been the bank for Indians. Widely trusted and near-ubiquitous, the SBI has come to symbolise banking across the length and breadth of the nation.

The Presidency banks of the 1800s the Bank of Bengal, the Bank of Madras and the Bank of Bombay set up by the British to facilitate trade and the repatriation of remittances to England, were its forebears. The SBI Story narrates the compelling circumstances that prompted the founding of the Presidency banks, how they fared back in the day and why they coalesced to emerge as the Imperial Bank in 1921, which came to be the State Bank of India in 1955.

Vikrant Pande traces the SBI's deep connection to India's economic progress, and the bank's proactive approach to change and to reinventing itself to meet the evolving needs of a growing nation. From banking for the classes to banking for the masses, it has striven to blend business goals with social obligations.

A history of the SBI is the story of how banking emerged in the last two centuries, and of how closely it participated in the key events that shaped a nation. Indeed, it is another way of looking at Indian history itself. Deeply researched and written in vivid prose, this book is a must-read for anyone interested in business and economic history.

Vikrant Pande has translated twelve Marathi works into English, including Sambhaji (Vishwas Patil) and Duryodhan (Kaka Vidhate). His most recent book (co-authored with Neelesh Kulkarni), In the Footsteps of Rama: Travels with the Ramayana, was published in 2021. 'The Tatas : How a Family Built a Business and a Nation, Vikrant's translation of Garish Kuber's Marathi work, Tatayan, won the Gaja Capital Business Book Prize 2019. Vikrant is a graduate of IIM Bangalore.

The history of banking began with the merchants of the world making grain loans to farmers and to traders who carried goods between cities. This was probably around 2000 BCE in Assyria, India and Sumeria. Later, in ancient Greece and in the Roman Empire, lenders based in temples made loans, accepted deposits and changed money. There is archaeological evidence that confirms the practice of money-lending as far back as in the ancient period in China and India. Evidence regarding the existence of money-lending operations in India is found in the literature of the Vedic times, i.e., 2000 to 1400 BCE, and of the Buddhist period, e.g., the Jatakas. The Sanskrit word 'mil (pronounced 'fin; meaning debt) used in the Vedic period implies the presence of banking.

The role of interest rates was recognised in ancient India. Interest rates were prescribed by almost all Hindu lawgivers Manu, Vasistha, Yajnavalkya, Gautama and Baudhayana as also Kautilya. A common base number was 15 per cent per annum what the banker-economist Dr. Thingalaya calls Hindu rate of interest. Incidentally, this is higher than current Prime Lending Rate (PLR) of many banks; said Dr Y.V. Reddy, former governor of the Reserve Bank of India (RBI), in a speech.

Chanakya's Arthashastra, while primarily about economic and military strategy, gives details of how the banking systems evolved. In the treatise, Chanakya says that the sons should pay with interest the debt of a deceased person or co-debtors or sureties. While a wife was exempt from her husband's debt, the husband had to pay if the wife had borrowed. 'Perhaps, this was the background in which one of the committees on rural indebtedness concluded that "the Indian farmer is born in debt, lives in debt and dies in debt"; said Dr Reddy. He jokes to say that in ancient India the people from the Vaishya community could take up banking and 'thus the caste system gave the licence; not the RBI r2 Incidentally, in ancient times, Brahmins were charged the least rate of interest.

During the Maurya period (321-185 BCE), an instrument called 'adesha' was in use. It was an order on a banker instructing him to pay the money of the note to a third person or a bill of exchange, as we understand it today. Shreshthi Chandandas was a famous banker in Pataliputra, and the word 'shreshthi' thus became a surname of the descendants of bankers. It appears that during the Buddhist period, which predated the Maurya period, there was considerable use of various banking instruments. For instance, merchants in large towns gave letters of credit to one another. The common currency was cowries (sea shells generally imported from the Maldives), copper, silver and gold coins. Colloquially, the cowries were referred to as laudis' and continued to be used in India till the early nineteenth century. In the medieval period too, bankers were active. Ballal Sena in Bengal in the twelfth century was in debt due to wars with the king of Manipur and he approached one Vallabhananda Adhya, the richest banker then, for a loan of one crore rupees. The famed Jain temples at Dilwara were built between 1147 and 1247 CE. It is said that Vastupala, the prime minster of Gujarat in the thirteenth century, drew a hundi of 10 crores on a city banker (Nagar Sheth) of Ahmedabad for the construction of the temple complex.

Modern banking can be traced back to medieval and early Renaissance Italy. In fact, the word 'bankruptcy' has its etymological roots in the Italian phrase 'banc rote; which literarily means 'broken bench. In Italy, bankers or money dealers used wooden benches. When a money dealer ran out of money, their bench was broken.

No story about European banking or money is complete without a mention of the Rothschild’s who, at one time, were the richest family in the world. Established by Mayer Amschel Rothschild in Frankfurt in the eighteenth century, the Rothschild banking empire grew rapidly during the French Revolution, with Mayer Rothschild facilitating payments from Britain for the hiring of mercenary soldiers. Then, in the early 1800s, Rothschild sent four of his five sons to live in Naples, Vienna, Paris and London, while one son stayed back in Frankfurt. The five branches, under his five sons, became, in a sense, the first bank to transcend borders. The Rothschilds made money by lending to governments for war-financing over the last few centuries. According to a long-standing legend, which though is not true, the Rothschild family owed the first million of their fortune to the successful speculation by Nathan Rothschild, the third son of Mayer Rothschild, about the effect of the outcome of the Battle of Waterloo (1815) on the price of British bonds. Even today, the Rothschilds continue to be one of the wealthiest families around.

The Bank of England too has its origins in war financing. It was incorporated by an Act of Parliament in 1694 with the immediate purpose of raising funds to allow the English government to wage war against France in the Low Countries (Belgium, Netherlands and Luxembourg). A royal charter allowed the bank to operate as a joint-stock bank with limited liability. No other joint-stock banks were permitted in England and Wales until 1826. This special status and its position as the government's banker gave the Bank of England considerable competitive advantages. It soon became the largest and most prestigious financial institution in England, and its banknotes were widely circulated. As a result, it became banker to other banks, which, by maintaining balances with the Bank of England, could settle debts among themselves.

In India, Gujarati bankers were active during Mughal times. During Aurangzeb's time, Virji Vora of Surat was a wealthy banker who had the courage to refuse an interest-free loan to the Mughal emperor, stating that it would set a bad precedent. Shantidas Jhaveri of Ahmedabad, a jeweller and banker, was a contemporary of Virji. As the Subandar (governor) of Gujarat, Murad Baksh, the son of the Mughal emperor Shah Jahan, had granted Shantidas Jhaveri the village of Palitana in 1656. Palitana later emerged as a major pilgrimage centre for the jains. The Lalbhai family of Ahmedabad, who founded the Arvind Group, traces its ancestry to Shantidas. Another name, yet again from Gujarat, is that of Travadi Arjunji Nathji of Surat, who, realising that the Mughal Empire was on the decline, sided with the East India Company. His acumen lay in his understanding of trade routes and exchange rates in various parts of the country. As the East India Company had ports in Gujarat (its first ship arrived in Surat in 1608), it was natural that many bankers operated there.

Haribhakti (named after the brothers Haribhai and Bhaktibhai Sheth), a famous banking house from Vadodara in Gujarat, supported Nana Phadnis, the minister for the Peshwas in Pune, in 1730. Pilaji Gaekwad, the ruler of Baroda, conferred the titles of 'Nagar Sheth' and 'Raj Ratna on the Sheth brothers. In 1740, the largest banking house in the South was that of Bukanji Kasidas, who too hailed from Gujarat and was styled as 'Sarkar's sowkar and the chief shroff of the province

The family of Jagat Seths can be traced back to Hiranand Sahu, a Marwari Jain from Nagaur in Rajasthan. Hiranand migrated to Bihar in the mid-seventeenth century in search of better prospects. In Patna, he made some money in the business of saltpetre, an essential ingredient for making gunpowder. During those times, saltpetre from India was much in demand in Europe because of its superior quality. It was also easy to carry on ships. So, the East India Company set up a factory in Bihar, for which they borrowed a considerable sum from Hiranand. While Hiranand had made these beginnings, it was his fourth son Manikchand who went on to earn glory for the family. The Mughal emperor Aurangzeb honoured Manikchand with the title of Seth. Later, Manikchand's adopted son, Fatehchand was given the title of 'Jagat Seth' by Emperor Farrukhsiyar (the Mughal emperor who ruled between 1713 and 1719).

Such was his prestige that no Mughal emperor dared to send the khillat (royal robes) to the Nizam of Bengal without sending one to Jagat Seth. The Jagat Seths were the Rosthschilds of India. According to some estimates, their wealth was around 14 crores in those times. One can only imagine what it would mean in current terms!

Gradually, trade started getting formalised and by the seventeenth century, there were agents (banias) in Calcutta. Agents existed in other parts of the country too, but were known by different names: in Madras, they were called dubashees; which literally means those who could speak two languages; in Bombay, which was the third important trading port in India at that time, they were called guarantee brokers or, simply, agents. As the credit needs of the East India Company merchants grew, the shroffs (traditional bankers) found it increasingly unsafe to invest large amounts in a trade of which they knew very little. The merchants had no recourse but to form agency houses and take up the business of banking and combine it with their commercial and trading activities. By the end of the eighteenth century, indigenous bankers had declined due to intermittent wars.

In the beginning of the nineteenth century, the British made attempts to introduce a uniform currency throughout the country. At that point in time, there were four types of rupee in circulation: the Murshidabad rupee, also called the sicca rupee, from Shah Alam's reign; the Arcot rupee coined at the mint of Fort St. George; the Surat rupee and the Lucknow rupee of the Nawab of Oudh. Besides, there were various gold mohurs. The business of money exchange was profitable and some communities exclusively dealt in it. They were called Poddars. The Poddars were different from the shroffs, or bankers, who were primarily Banias, Vaishyas, Marwaris and Chetties. The Marwaris, as the name suggests, came from the Marwar region (in present-day Rajasthan), while the Chetties operated in the region that is now Tamil Nadu. In Punjab, there were the Aroras and Khatris.

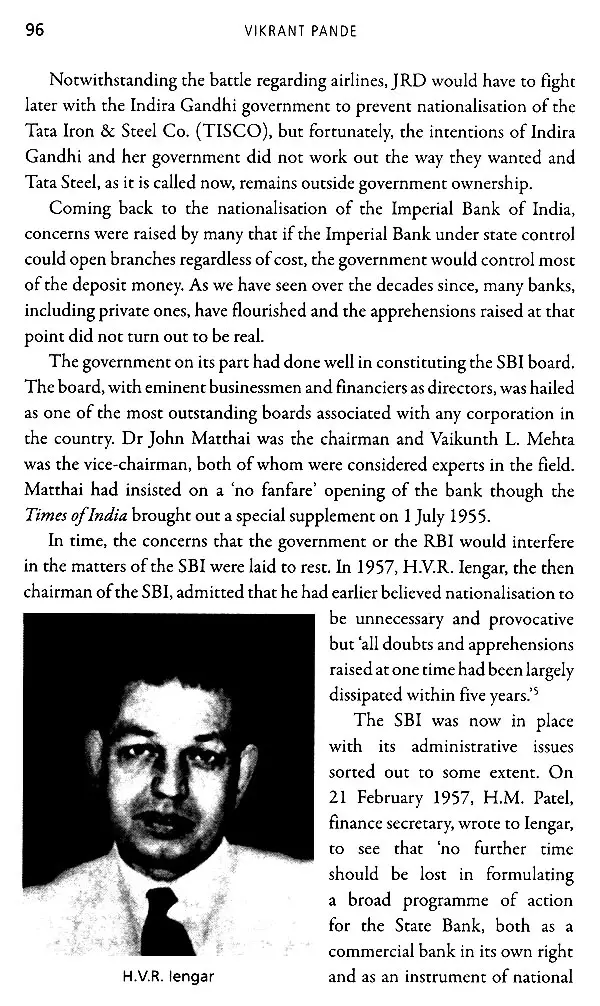

The 'banks' operating in India in the early nineteenth century were primarily performing the function of regularising the rates of conversion between different types of coins circulating in the East India Company's territory and regulating the rate of exchange for hundis or bills of exchange collected from various parts of India. Indian banking experienced a strong English influence in policies and practices of the banks which were established in the early nineteenth century. The Presidencies of Calcutta, Madras and Bombay had their own banks and while the charters of the Presidencies were similar, the variegated nature of the vast landmass of India and the local conditions made for different types of institutions to emerge with their own unique character. The amalgamation of the Presidency banks created the Imperial Bank in 1921. Later, the Reserve Bank of India (RBI) was formed in 1935, while the Imperial Bank was nationalised to form the State Bank of India (SBI) in 1955. The SBI thus has its roots stretching more than two centuries back.

27 January 2021 was an appropriate date to visit the SBI Museum located at 1, Strand Road, at the Kolkata Local Head Office, once again. It was on the same day a century ago in 1921 that the Imperial Bank of India was formed. My journey into the world of the State Bank of India (SBI) was serendipitous. I visited the SBI Museum after reading a newspaper article sent by my editor, friend and mentor at Westland, Minakshi Thakur, describing the wonderful museum. The museum does not fail to impress. It was during the visit that I discovered the treasures it holds and decided to write a history of SBI for the common man. My editor, Karthik Venkatesh, immediately liked the idea of book on the history of SBI when I proposed it to him.

A person entering the SBI Museum is greeted with an imposing twelve-feet tall fiberglass statue of 'Prince' Dwarkanath Tagore, one of the early clients of the Bank of Bengal. The archives display names of account holders like Motilal Nehru (current account in 1917), a joint account of Justice N.G. Chandavarkar, Pherozeshah Mehta and Dinshaw Eduljee Wacha, a loan account of Ishwar Chandra Vidyasagar (for the period 1873-74), a current account of Dinshaw Maneckji Petit in 1903, a current account of Dadabhai Naroji in 1875, Ashutosh Mukherjee (the father of Shyama Prasad Mukherjee), Rabindranath Tagore, Jagadish Chandra Bose (securities account in 1928), M. Hidayatullah (from 1905 to 1992), Dr Rajkumar Amrit Kaur and many such stalwarts.

The museum, amongst many things, displays the weights used to weigh gold to exchange for coins. There is a treasure trove of interesting facts. The visitor can see in the gallery how India's banking system evolved from the time of money lenders to the commercial banks of today. The 107-feet high mural on the face of Samriddhi Bhawan on Strand Road is the tallest mural in Kolkata and captures the evolution of the SBI.

I was fortunate that the detailed and academic work done by Prof. Bagchi and Mr Abhik Ray did not require me to delve into the archival material stored in another room. It is otherwise an impressive storage and a researcher's delight, if one is inclined to spend countless hours poring over old records!

That Prof. Amiya Kumar Bagchi and Abhik Ray had done remarkable, detailed and unparalleled work made it easy for me to pick nuggets from their voluminous work which runs into thousands of pages. It is to them that I owe my gratitude. It would have been impossible without the extensive support of Mr Abhik Ray. Meeting Prof. Bagchi and listening to his erudite yet humble conversation was a pleasure. Mr D.N. Ghosh, former bureaucrat, ex-chairman of SBI who wears multiple other hats, recounted many stories with vivid clarity while I sat listening to him in Bengal Club.

I was helped by my dear friend Anup Bagchi of ICICI Bank, who connected me with many senior persons in the bank. Anup, a special thanks to you.

Karthik Venkatesh and Sonia Madan, with their edits, have made the book eminently readable. I hope everyone enjoys it.

**Contents and Sample Pages**