Euro in Economic Monetary Union Crisis To Cohesion- A Decade Long Overview

Book Specification

| Item Code: | UAC797 |

| Author: | Mala Rani |

| Publisher: | Synergy Books India |

| Language: | English |

| Edition: | 2022 |

| ISBN: | 9788194843023 |

| Pages: | 165 (Throughout Colour Illustrations) |

| Cover: | HARDCOVER |

| Other Details | 9.50X6.50 inch Depth |

| Weight | 390 gm |

Book Description

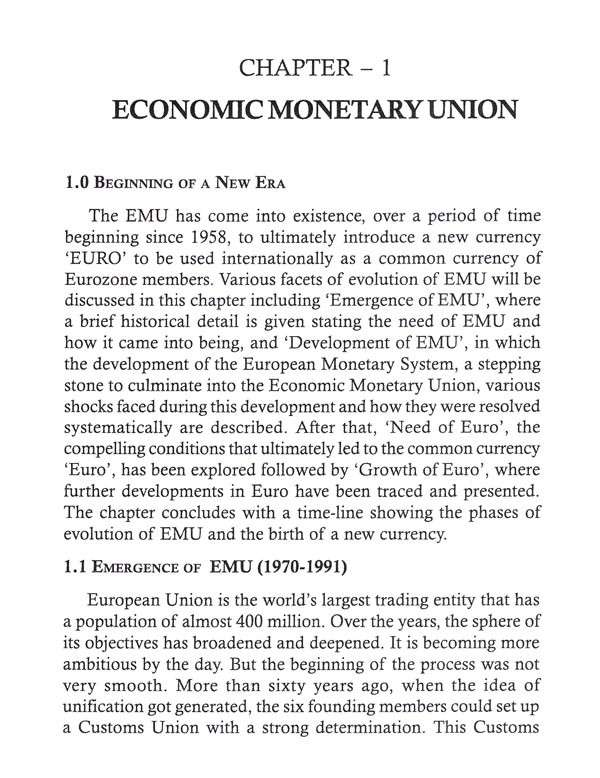

The creation of the Economic Monetary Union (EMU) was hailed as both a political as well as an economic innovation. Politically, the Union implied the foregoing of national sovereignty and development of a supra national structure toward a Euro village. Economically, it was expected to herald an era of economic cooperation and the advantages of a single currency, such as, reducing the transaction costs and exchange rate risks, increasing price transparency and competition, better prospects of intra-regional trade and investment, etc. Starting in the period 2008-09, the EMU has been experiencing the economic crisis, the most difficult moments of its existence, giving rise to political, economic and academic debate on the desirability of making or breaking the Union. A hindsight and a foresight-based examination of the concept, theory and evidence of the outcomes of the Economic Monetary Union have gained importance for researchers. Present study has been undertaken to gain insight and make comprehensive information available to those interested in knowing the international developments that are taking place and are going to affect global economy.

The concerted efforts were made to gather the consistent data for the period 2000-2011. The larger amount of data is taken from EUROSTAT, the statistical division of the official website of EU, www.europa.eu. The embassies of Greece and Austria were approached for the missing data. To fill the remaining gap, World Bank Reports (the Annual Report explores a challenge facing the developing world and how the World Bank is responding to help people help themselves) and OECD (known as an international statistical agency, as it publishes comparable statistics on a wide number of subjects) publication of the selected member states for the period 2000-2011 were also accessed for arranging the data sets.

The measure findings of the study are reproduced as follows.

✓ There is no distinct change in economic conditions of member states during pre- and post-Euro periods. However, chances are bright that the Economic Monetary Union will meet success.

✓ The ability of a member to derive benefits from EU is contingent upon its domestic factors.

✓ Internal devaluation needs to be implemented as and when the need arises.

✓ Structural reforms, such as, deregulation of product/retail market, streamlining rules for investment, implementation of policies for innovation and removal of barriers to entry for service professionals, require to be adopted by individual members.

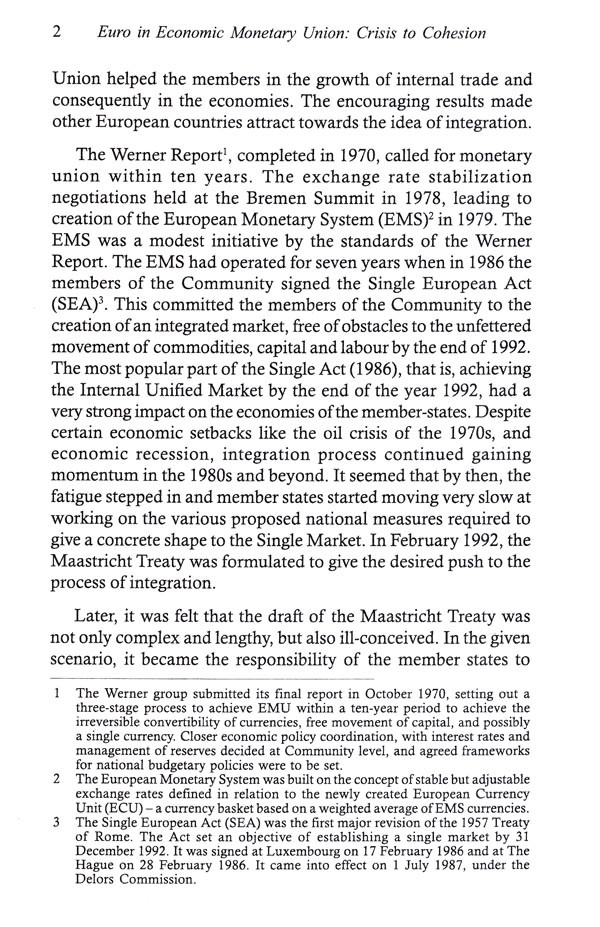

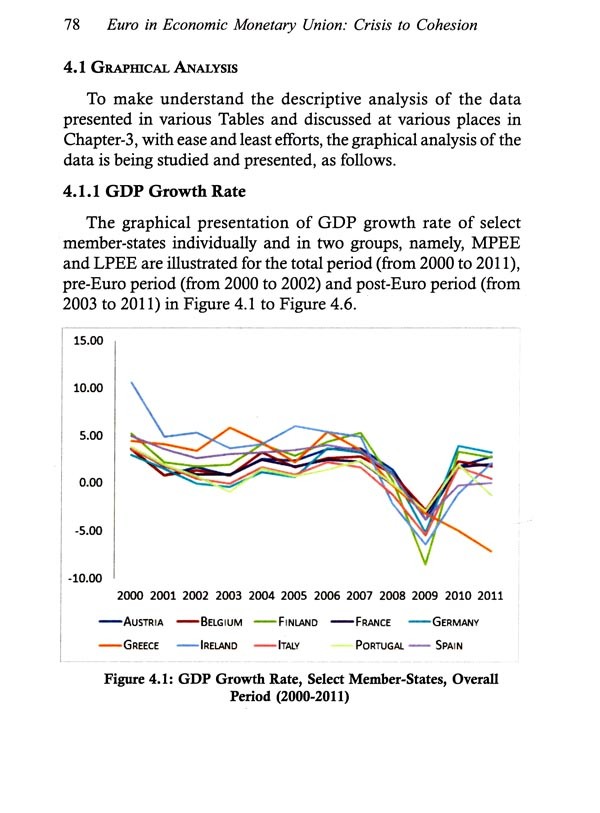

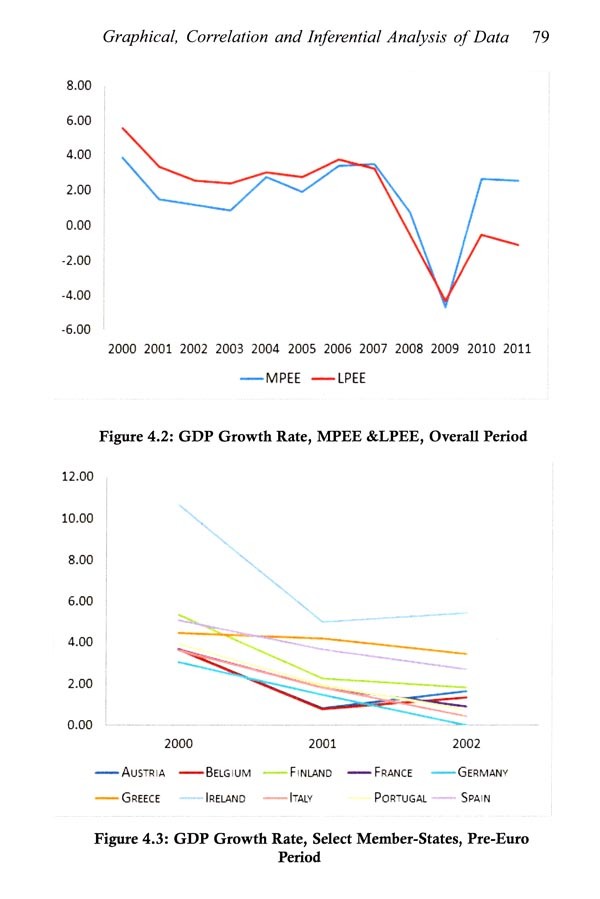

✓ Analysing the data of GDP from the year 2000 to 2011, it is inferred that EMU created unsteadiness among the economies of the LPEE countries.

✓ The data on Rate of Inflation suggest that except Germany, all other member states breached heavily its permissible limit of 1.5 per cent.

✓Cash balances of MPEE and LPEE show that after EMU, both the groups hold lower cash balances in comparison to what they had prior to EMU.

✓ As opposed to the notion that LPEE members were spending heavily social contribution, it is found that the MPEE group have throughout spent a much higher percentage of their revenue on social contribution.

✓ The study has revealed that by and large all the members, irrespective of their belonging to MPEE or LPEE, suffered a serious escalating worsening of their balances of payments following the adoption of Euro.

✓ Similarly, no matter whether it was MPEE or LPEE, the norms of maintaining the budget deficit within the permissible limit of 3 per cent (agreed at Maastricht) were flouted by all. Surprisingly, only Spain, the member of LPEE, enjoyed budget surpluses for a small span of period from 2005 to 2007.

It gives me immense pleasure to write this foreword as I have been involved through the genesis of this study, I am impressed with the dedication, hard work, sincerity and intelligence of my research scholar Mala Rani. Initially, I was reluctant to admit a working teacher of University of Delhi, otherwise unfamiliar to me, as a Ph.D. student, assuming that she will not be able to devote sufficient time on this demanding task. But I am deeply satisfied with the time management skills of my student who could finish and submit her thesis well in time before my superannuation. I have been persuading her for some time now to publish her valuable research findings.

This book is a tremendously important and in-depth contribution to the subject of Economic Monetary Union. The book has brought together diverse macroeconomic variables under an umbrella to make it easier to compare and analyse the economic status of two broad categories of ten member-states of European Union.

An excellent effort has been made by the researcher author Mala Rani in this much needed book to address the lack of a comprehensive study on differential impact of European Monetary Union on select member states during 2000-2011. The Book is a rare study of a complex but real theme of how the European Monetary Union is accompanied by the unification of currency but highly uneven developmental impact of this process in different parts of the European Continent. Hence, it highlights the urgency of policies and concrete measures to overcome this phenomenon which has its own impact on European politics.

I am confident that the book is capable of attracting the attention of policy makers. The detailed and comprehensive analysis of data, the exhaustive references and subject index has made the book very useful for its readers.

I have no doubt that this book will be well received by the researchers and academia. I wish the book and my able student Mala Rani all the success.

**Contents and Sample Pages**