Rural Banking System: Promises and Performance Evaluation

Book Specification

| Item Code: | UAN975 |

| Author: | Dr. Dilip K. Chellani |

| Publisher: | Bharatiya Kala Prakashan |

| Language: | English |

| Edition: | 1998 |

| ISBN: | 8186050248 |

| Pages: | 180 |

| Cover: | HARDCOVER |

| Other Details | 8.80 X 5.80 inch |

| Weight | 350 gm |

Book Description

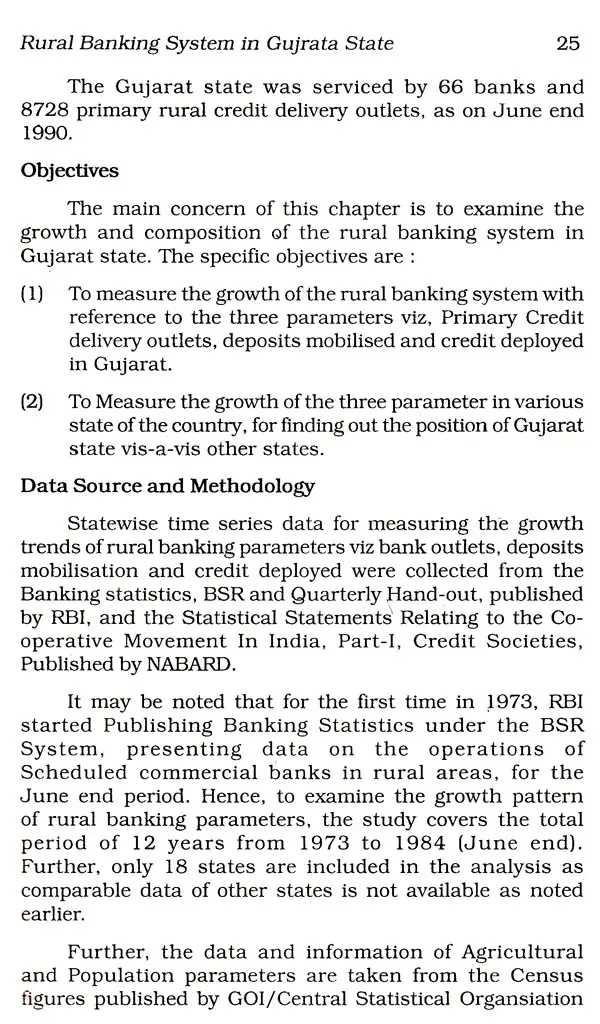

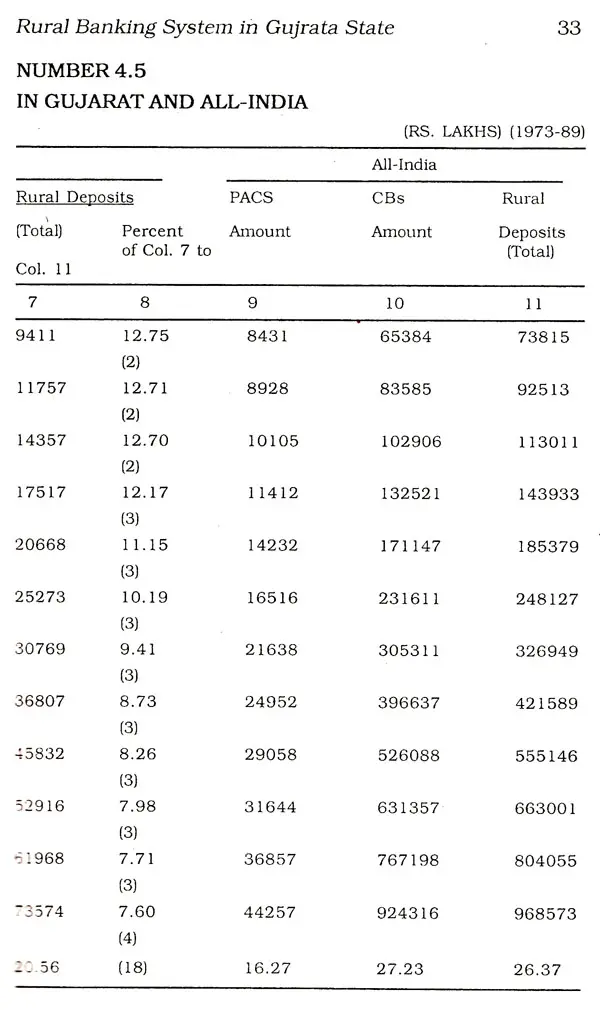

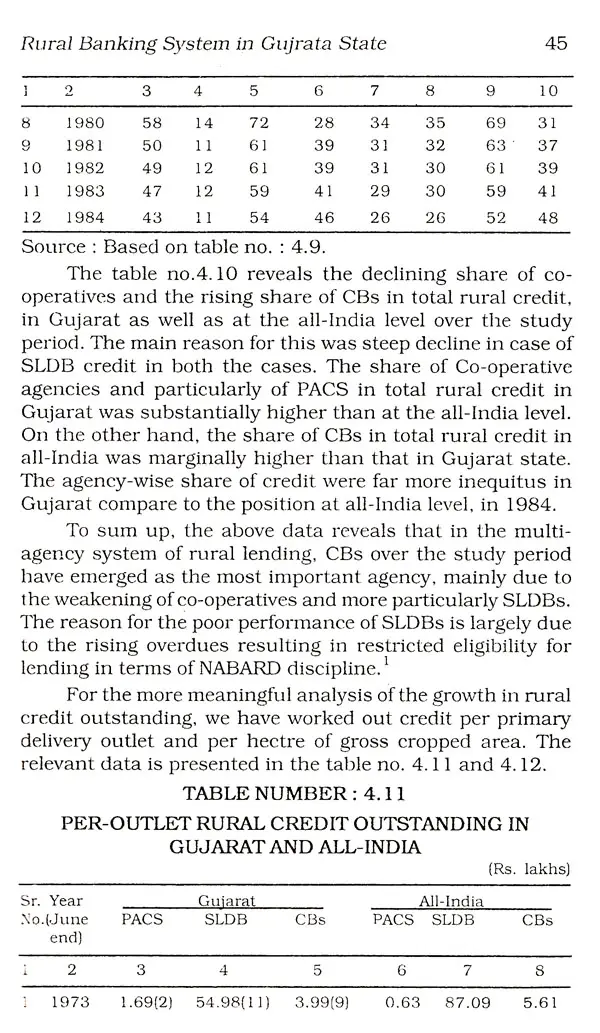

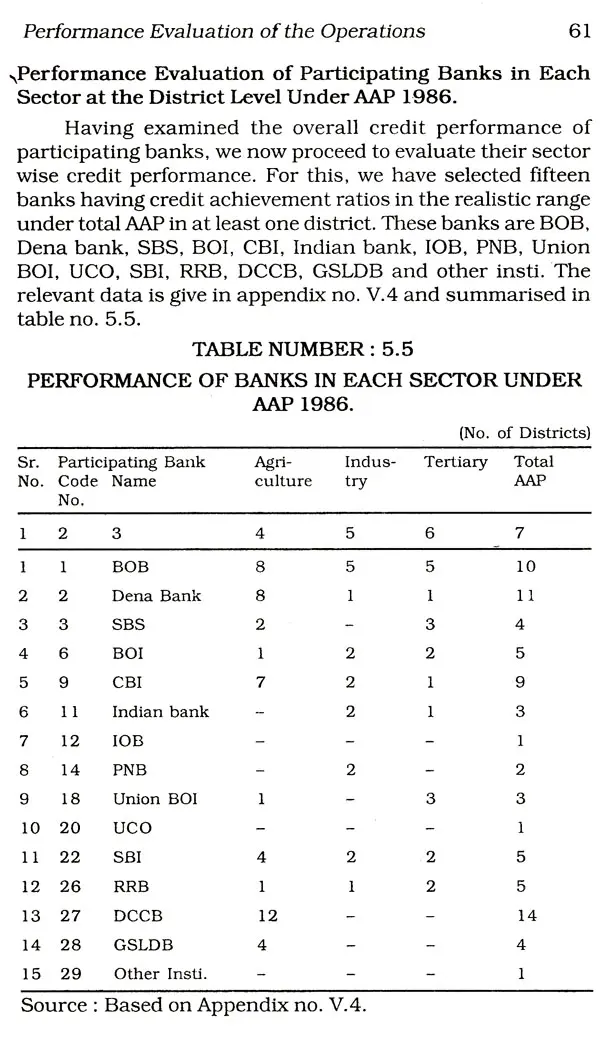

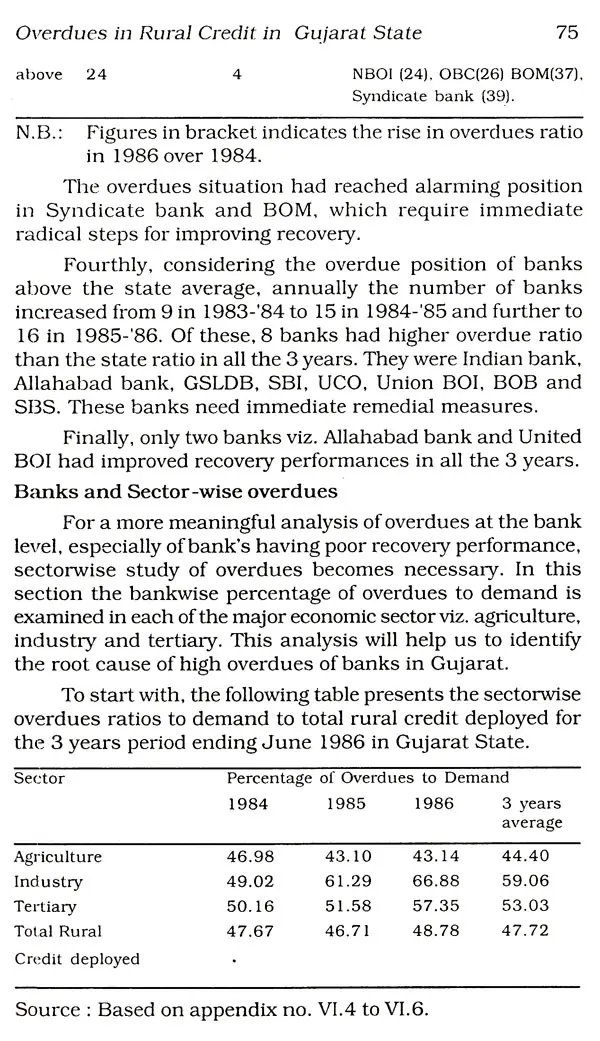

The data presented indicates that the RBS in Gujarat is siphoning out money from Gujarat, a trend which needs to be checked in near future. The policy implication of the study is that Cooperative system in the State of Gujarat needs to be strengthened. More attention needs to be paid to the operational aspects of alignment and recovery of the Industry and tertiary sector advances. Bank wise monitoring of overdoes is more advantageous and meaningful for drawing policy lessons.

Dr. Chellani has also served Sukhadia University, Udaipur as Assistant Professor in Banking. He is teaching & guiding research in the areas of rural banking. He has prepared Rehabilitation Plans and Development Action Plans of various sick District Central co-operative Banks in Gujarat. He has also published research papers in the reputed professional journals of the country.

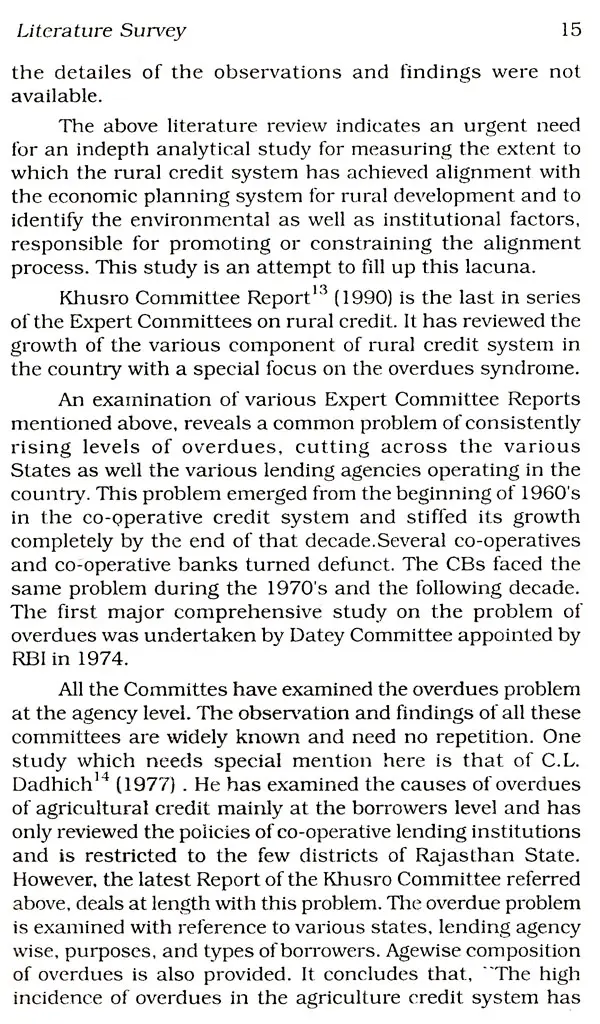

Economists look at rural credit in the context of demand and supply of rural finance and factors influencing them. System scientists have emphasised the complex interactions typically found in a commercial bank or a cooperative. A holistic approach is advantageous as problems faced by rural banking institutions are rarely amenable to highly sophisticated and abstract models.

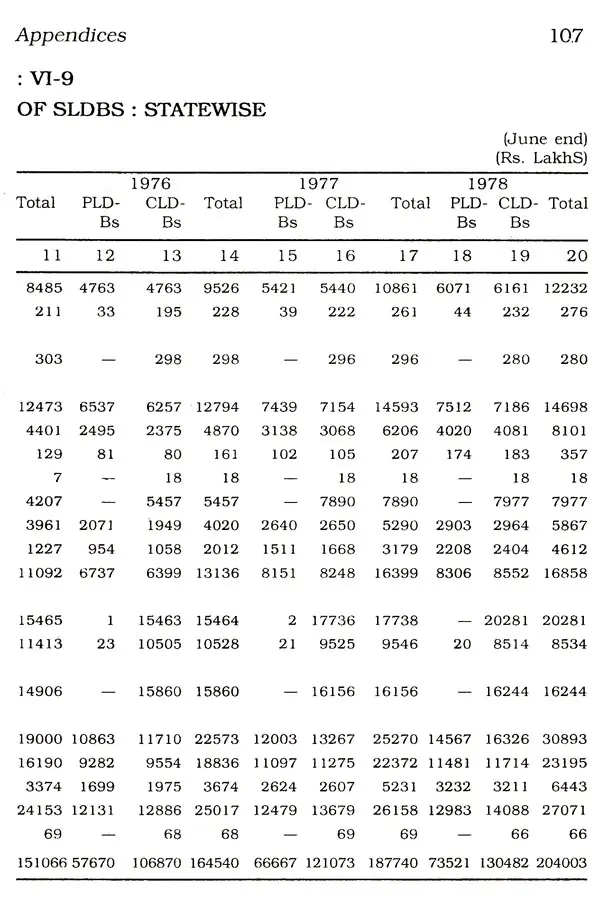

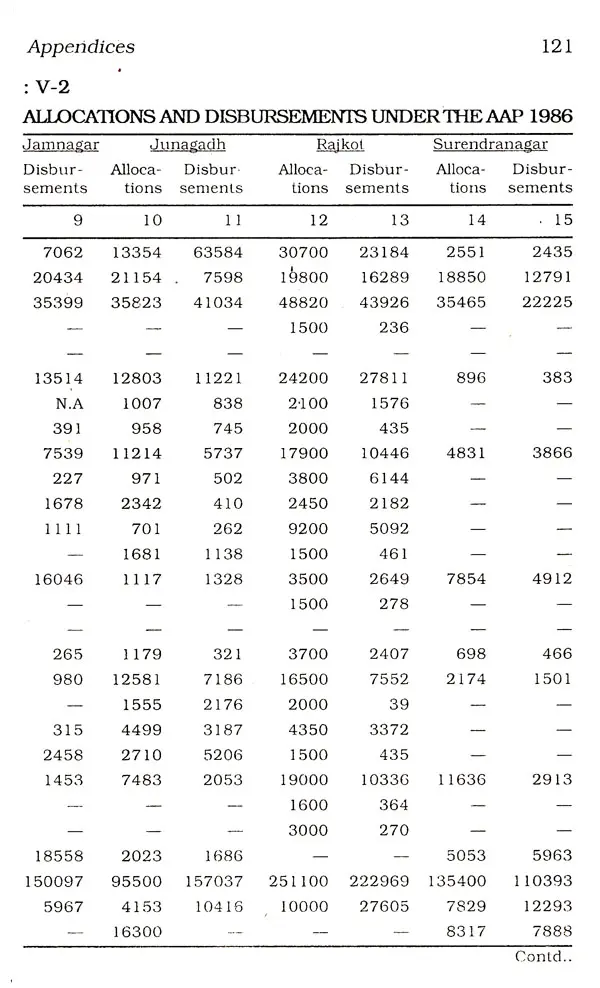

India being a very large country, its agriculture is marked by diversity and varying stages of technology at a given point of time. Hence, macro-level studies of rural banking have restricted utility. Moreover, agriculture being a state subject for legislative purposes, rural banking policies, institutions. plans and programmers are better evaluated at state or district level. In this context, Dr. Chellani's study of rural banking in Gujarat is very apt. It is a comprehensive research work, where in, the growth trends of the rural banking system are studied with reference to three important parameters, viz. branches (outlets), deposits and advances. Further, the performance of all the three lending agencies are also evaluated separately viz. commercial banks, cooperatives and regional rural banks.

This is a problems oriented enquiry, where focus is on two major problems of the rural banking system. The first one is the alignment of the rural banking and rural development planning systems. The second problem is the well-known-high level of overdoes of advances. As the study is based on primary data and informative evidence painstakingly collected single handedly, its observations and conclusions, have useful policy implications.

It is important to note that research on these issues is not abundant. Particularly, little research is addressed to the alignment achieved between the two major partners in rural development: the banking and the development planning system. Hence the importance of this study lies in the clues and the insight provides into how to achieve the best alignment.

Overdoes problem has proved to be unsurmountable. The study shows that Gujarat which has progressive agriculture compared to most other states has the highest and rising level of overdoes during the study period, among all the states. Bank level analysis of the overdues problem turns out to be most meaningful exercise in terms of finding policy imperatives. I am sure Dr. Chellani's study will receive attention of the development planners, bankers and policy makers. Above all, it will provide very useful reading material to students of rural banking at all levels.

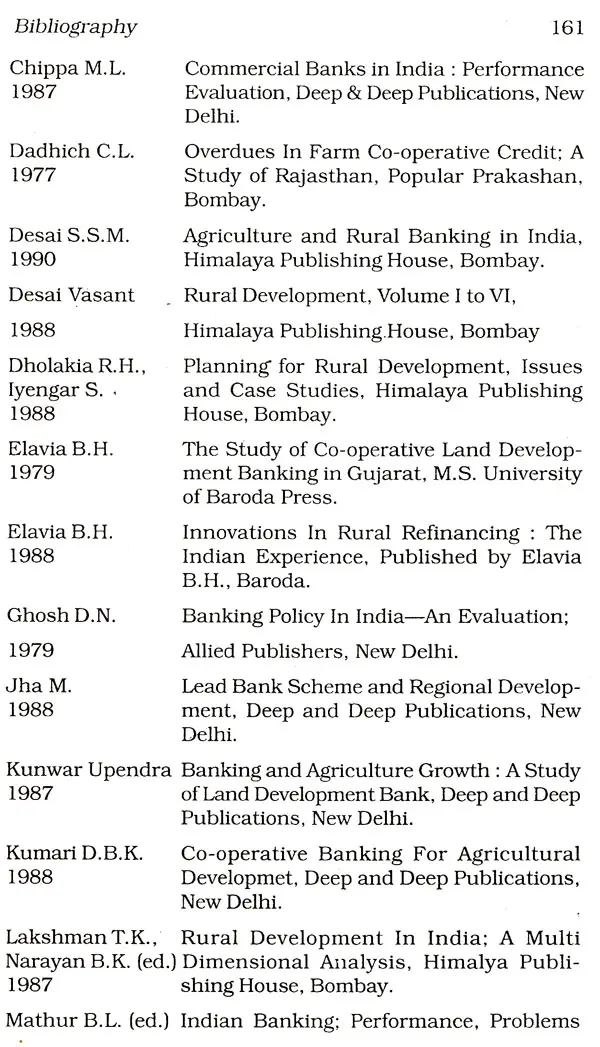

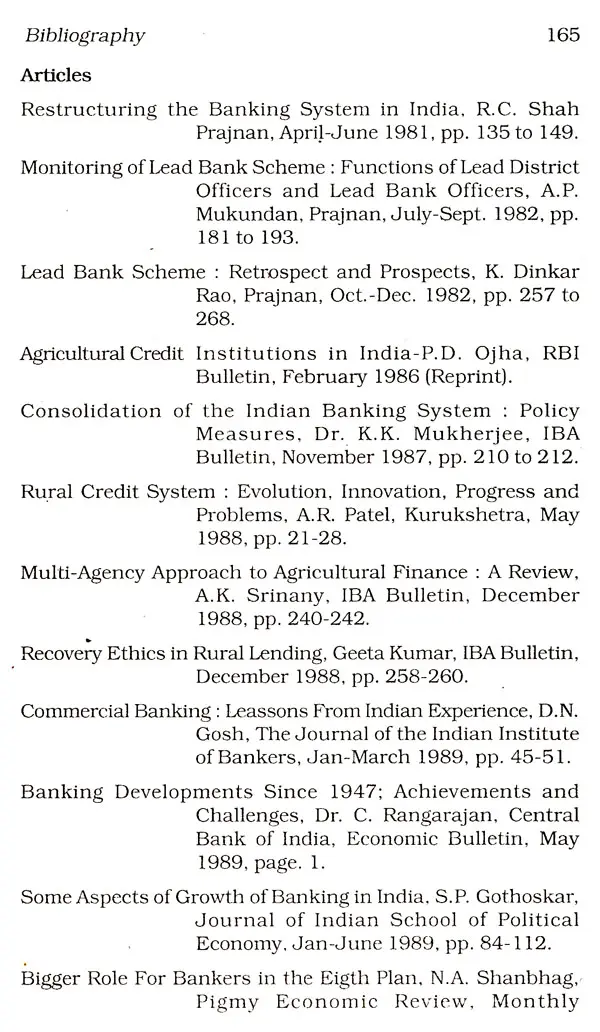

**Contents and Sample Pages**