Yes Man- The Untold Story of Rana Kapoor

Book Specification

| Item Code: | NBZ025 |

| Author: | Pavan C. Lall |

| Publisher: | Harper Collins Publishers |

| Language: | ENGLISH |

| Edition: | 2021 |

| ISBN: | 9789390351008 |

| Pages: | 230 |

| Cover: | PAPERBACK |

| Other Details | 8.50 X 5.50 inch |

| Weight | 210 gm |

Book Description

Twitter, the social media platform which is an increasingly popular choice for Indian promoter-billionaires who don't want to deal with the double-edged consequences that can come with mainstream media interviews, was being used by Kapoor with good reason.

Fourteen years after the creation of Yes Bank, Kapoor, who was seen in the business world of bank promoter-founders as a latecomer-albeit a successful one-was starting to face questions around corporate governance and the manner in which Yes Bank was giving loans to companies.

Three months ago, the bank's shareholders had given Kapoor's reappointment the green light, before sending it to the Reserve Bank of India (RBI) for final clearance. However, that never happened despite the bank board clearing Kapoor's appointment until 2021. If the tweets were expected to bolster the bank's stock prices, they fell woefully short. On the contrary, Yes Bank's share value fell by more than a third one week later, thanks to news that the RBI was ejecting Kapoor.

The message was loud and clear: Yes Bank had been told to find his replacement within the next three months.

What had caused the central bank to react in this manner? In recent times, the banking industry had started to clamp down harder on corporate finance, thanks to a growing number of bad loans across both private and state-owned banks.

The asset quality review across banks, which was initiated in December 2015, resulted in an increase in bad loans over 6,00,000 crore. The list of lenders included Yes Bank. All banks were asked to disclose how they were reporting bad loans. One likely and immediate trigger that had brought on the heightened scrutiny had transpired just seven months ago in February.

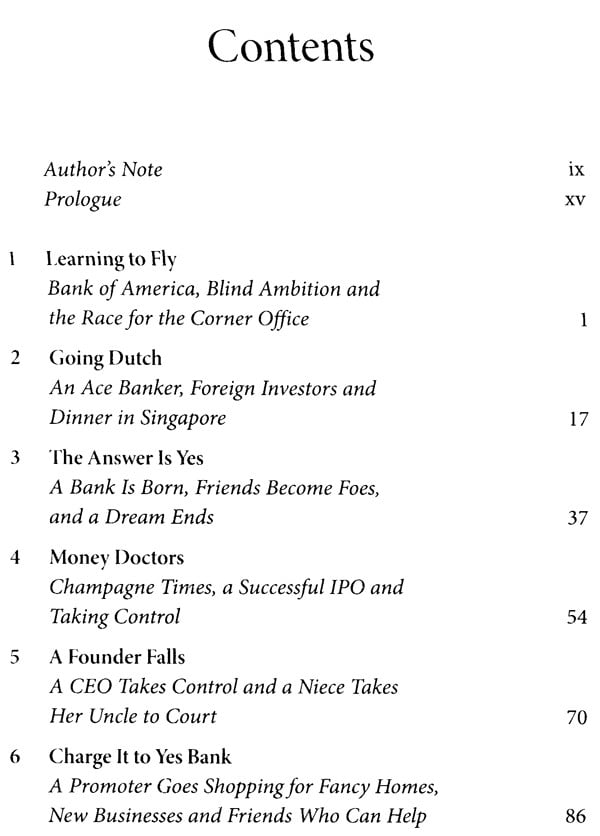

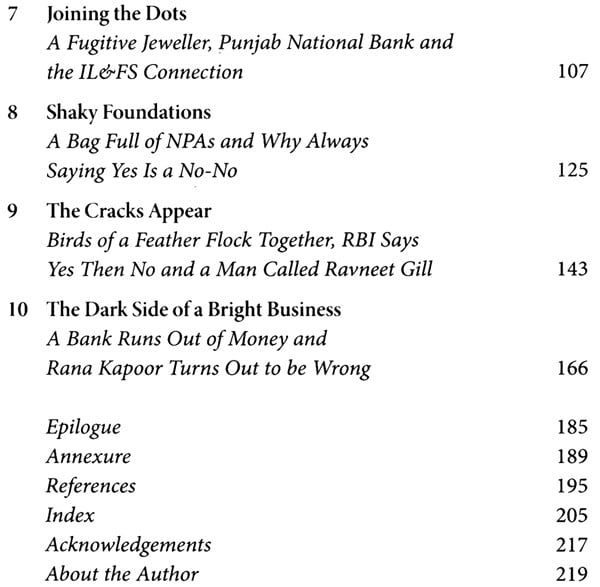

Book's Contents and Sample Pages